What is Wealthfront Financial?

First introduced in 2008, Palo Alto, California-based Wealthfront provides investment services primarily for retirement, although it takes into account other significant financial decisions that might come along including college for your kids, buying a house, an upcoming large expensive, and more. Before being asked whether you want to open an account, Wealthfront asks for personal financial information by requesting to link to your accounts. These include banking, retirement, and investment accounts, plus loans, including mortgages. As you begin linking your accounts, Wealthfront’s algorithms get to work before offering an investment plan. Have you forgotten an account? No worries, as you can add other financial details to your plan at any time; the more Wealthfront knows about your current financial situation, the better.

What it Offers

One of the great things about Wealthfront is there’s no pressure to open an investment account. Instead, it uses your inputs to suggest a plan. From there, you can use this information to invest with Wealthfront — or take this information elsewhere. As part of this no-pressure approach, Wealthfront also makes recommendations on what you can do with your current accounts. For example, at the minimum, it might recommend adding more money to your bank savings account each month. Most likely, it will also suggest you open an IRA (Roth or Traditional) or individual retirement account.

Opening an Account

If you decide to open an account through Wealthfront, it will ask you a series of questions to get started. It’s here where the company begins offering products that extend beyond retirement. Choices include high-interest cash, general long-term investing, retirement investing, and college investing.

High-Interest Cash

For a cash account, Wealthfront offers unlimited transfers and $1 million in FDIC insurance on funds you might want to access within five years. The current APY offered is 2.32 percent. You can open an individual, joint, or trust account. Cash accounts offer:

No fees. No advisory fees, no management fees, no surprises.Zero market risk. Your cash is kept out of the markets, so you never have to worry about short-term volatility.Unlimited, free transfers. Quickly move your money in and out of your cash account at no cost to you.$1 minimum. It only takes $1 to open, and there are no additional deposit requirements.

Yes, you heard right, $1!

General Long-Term Investing

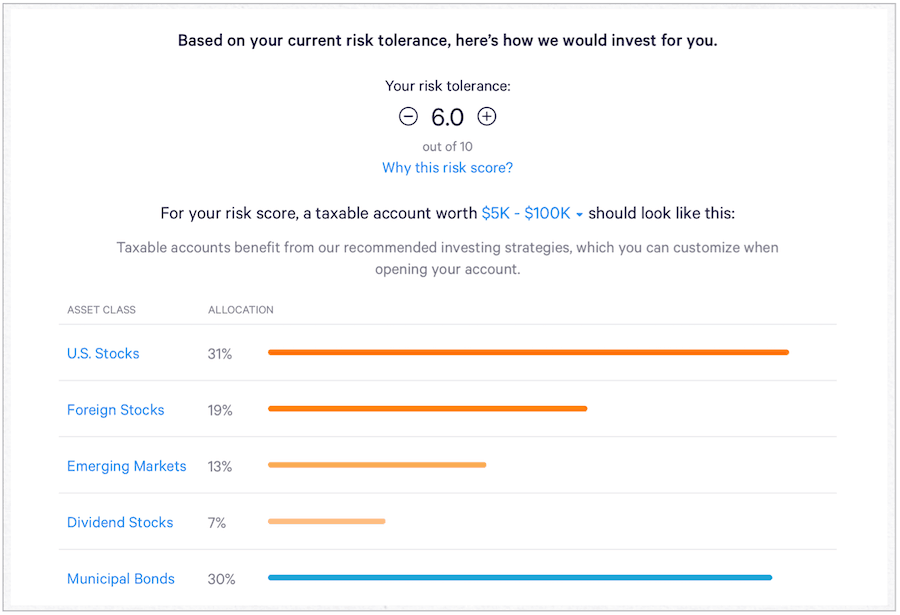

An all-purpose general long-term investing account is recommended if your goals are at least five years away. Again, you can open an individual, joint, or trust account. Before setting up your investment account, Wealthfront will ask for your birthday and pretax income (again). It also wants to know the total value of your cash and liquid investments. From there, you’re asked whether maximizing gains or minimizing losses or a combination of both, is most important to you when investing. It only wants to know what you would probably do if your portfolio suddenly dropped 1o percent due to a market decline. Based on this information, Wealthfront assigns you a risk tolerance score that’s based on your age, years until retirement, and financial capacity for risk. In doing so, it will suggest an investing strategy like the example below.

As a final step, Wealthfront wants to know which strategy you want to use to lower your tax bill and increase your expected returns. For first-time or minimal investors, it will almost certainly recommend tax-loss harvesting. With this solution, Wealthfront reduces your tax bill by automatically capturing investment losses, which can offset capital gains and ordinary income. The minimum initial deposit for a general investment account is $500.

Retirement Investing

F0r retirement accounts (funds you won’t need until you’re at least 60), Wealthfront offers traditional, Roth, and SEP IRAs. The setup process is similar to the one you use to open a general investment account. The minimum initial deposit for an IRA is $500. Note: If you have an existing investment or retirement account and want Wealthfront to manage it going forward, you can do so on the company’s website.

College Investing

Finally, Wealthfront offers 529 accounts to cover educations expenses. It mentions, however, if your state offers tax deductions through sponsored 529 plans, you should probably stick with what they provide. The Wealthfront 529 College Savings Plan (Plan) is administered by the Board of Trustees of the College Savings Plans of Nevada (Board).

Odds and Ends

Wealthfront offers online information about investing and borrowing that’s open to anyone to review. It also provides financial health, home buying, and equity and IPO guides — all free of charge. This information presented tends to get updated often and is written to appeal to anyone new to investing. Opening an account through Wealthfront is a simple process, regardless of the type of account you select. Once you become a customer, you can unlock additional accounts at any time. For example, you might start by opening a cash account, but later decide to open an investment account.

What About Real People?

Wealthfront doesn’t give you access to real people to discuss investing. If this type of support is essential to you, Wealthfront recommends using Betterment, a competitor. It notes: Don’t you love Wealthfront’s honesty? Why should you choose Betterment? If you prefer scheduling meetings and talking to someone on the phone and don’t mind paying higher fees to do so, Betterment may be the better choice.

Fees

There’s no fee for opening or maintaining a savings account through Wealthfront. For investment accounts, the company charges an annual advisory fee of 0.25 percent on all assets under management, which it deducts monthly. Wealthfront doesn’t charge any account-opening fees, withdrawal or account-closing fees, trading/commission fees, or account transfer fees. You can learn more about Wealthfront through its website or download the app in Google Play 0r the App Store.

![]()